Globalising China Part 2: Fast Foreign Economic Expansion

As discussed in the Domestic Market of the People’s Republic of China in the previous edition of this magazine, the staggering economic growth of China has garnered a lot of attention and, in many cases, the rise of China is perceived by governments and companies of many other countries alike as a threat to national security, domestic economies and the overall business climate. What are the hallmarks of the Chinese domestic economy and how has it achieved such rapid growth through trade and OFDI? This section gives an overview of the current state of Chinese OFDI, its development and the events and policies influencing its growth.

Copyright: Du Yongle (杜永乐)

China’s Outward Foreign Direct Investment (OFDI)

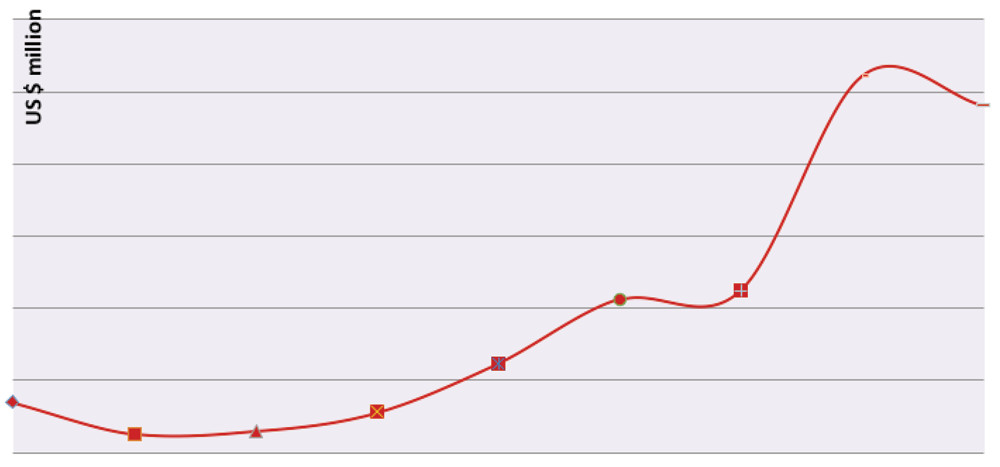

In combination with its attractiveness as a production location, China today has become a very busy home for multinational activities. In 2009, China received a total FDI inflow of USD 95 billion (€68.95bn), which was actually a drop of 12% with respect to 2008 (UNCTAD, 2011). Nevertheless, this amount makes it the second largest recipient of FDI behind the United States, which suffered a decline of 59% in 2009. In contrast to its inflows, OFDI flows from China are a more recent phenomenon and have amounted to a considerable size in a relatively short period (see Fig. 1).

Figure 1: Chinese outward FDI flows from 2001-2009 (USD millions)Source: UNCTAD, 2011

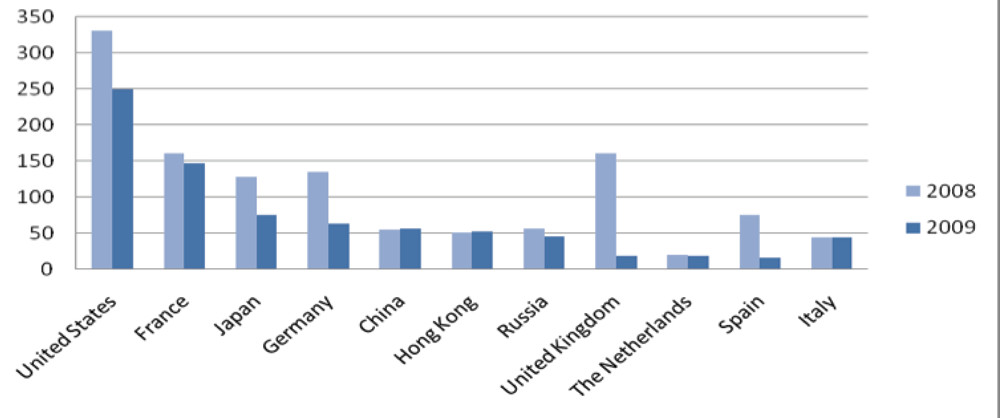

In spite of the global trend of decline in OFDI seen over the past two years, Chinese OFDI actually managed to increase during this period. Especially in the last five or six years, Chinese OFDI flows picked up quickly (see Fig. 1). Total flows of Chinese OFDI reached USD 56.53 billion by 2009 making China the fifth largest investor worldwide behind the United States, Germany, France and Japan for that year (see Fig. 2).

Figure 2: Largest investors by OFDI flows in 2008 and 2009 (USD billions) Source: MOFCOM, 2010, UNCTAD, 2011

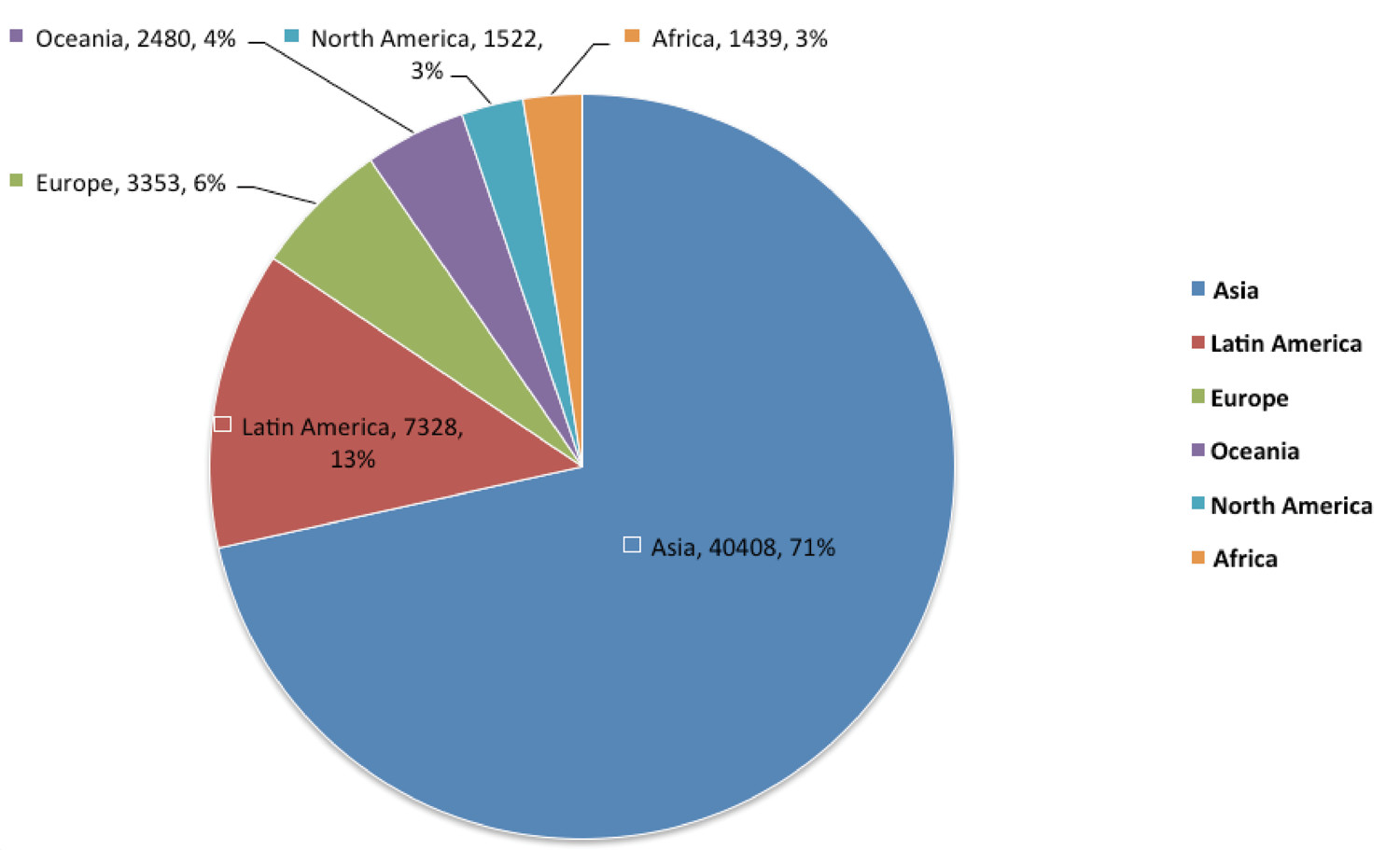

China has built up its foreign OFDI stock at a breathtaking pace around the world. Unsurprisingly, the centre of gravity of Chinese OFDI stock lies in Asia (see Fig. 3). Accounting for 89% of Chinese OFDI stock in Asia, China’s Asian OFDI stock is concentrated in Hong Kong (香港), Singapore (新加坡) and Macao (澳门). Strong cultural links, diplomatic ties and quickly developing economies make Hong Kong, Singapore and Macao attractive destinations for Chinese OFDI. Quite striking is the high rank of Pakistan on the list. Apart from Chinese assets in mining and infrastructure, Chinese investments in Pakistan seem highly driven by regional security as both countries share a rivalry with neighboring India.

Figure 3: Destinations of Chinese OFDI flows in 2009Source: MOFCOM, 2010

The intentions to invest abroad are clearly present among Chinese companies and the amount of foreign assets is increasing. As Chinese companies are relative newcomers to cross-border investment, the question arises: to what extent do they become transnational corporations? Many Chinese companies with large foreign assets have significant state involvement. According to UNCTAD’s transnationality index, which determines the largest emerging market companies by foreign assets, overseas sales and employment, only two Chinese companies have more assets abroad than in China: Beijing Enterprises Group (北京控股集团 Bĕijīng kònggŭ jítuán) and TPV Technology Limited (冠捷科技集团Guànjié kējì jítuán). The other companies may have a lot of foreign assets but have scores under 50% on the transnationality index. Chinese state-owned resource companies, such as CNOOC (中国海洋石油总公司Zhōngguó hăiyáng shíyóu zŏnggōngsī) and China National Petroleum Company (中国石油天然气总公司 Zhōngguó shíyóu tiānránqì zŏnggōngsī), have very low transnationality scores of 9.4% and 2.7% (UNCTAD, 2011). Foreign assets of large Chinese companies are growing quickly but the low transnationality scores underline that the majority of enterprises are still in an early stage of internationalisation.

The most influential stage of Chinese OFDI policy development is definitely the implementation of the ‘go global’ policy. The state gradually stepped away from its interventionist role and increasingly assumed the role of facilitator. Outward investment was no longer restricted to state-owned enterprises, but since 2003 privately owned enterprises have been able to invest abroad. Their involvement in OFDI has received extra encouragement since 2006 (Rosen et al., 2009). Under the ‘go global’ policy, administrative approval procedures for foreign investments projects have been simplified and standardised and guiding catalogues have been set up directed at special regions and industries. In its monitoring activities, the government has started to emphasise performance rather than quantity as it used to do.

Capability Constraints of Chinese Firms in the Global Market

Although Chinese firms have implemented various expansion strategies successfully and have built up firm-specific advantages, they do reveal some weaknesses that can affect growth and international expansion. For instance, for some industries and products, the Chinese domestic market, or any other emerging market, is relatively small or non-existent compared to the global market (Williamson et al., 2010). Certain Chinese firms will have a hard time establishing sizable production volumes for domestic or peripheral markets before building up cost-advantages in foreign markets.

Copyright: Xinhua

Another limitation to Chinese corporate expansion strategies is the immaturity of its industries and technologies. Insufficient knowledge and strength in base technology and the lack of international experience can hamper development of Chinese firms. As the pace of technological change and evolution is rapid, Chinese firms may struggle in keeping up with developments and to put out reliable products. Acquiring foreign technology can become a cost burden when product life cycles outrun firms.

Chinese companies are still quite inexperienced managing and coordinating a complex, interrelated global value chain. Especially in fast moving consumer goods industries and pharmaceuticals, the value chain is intricately sliced and requires a systematic approach. For Chinese companies, it is often unclear in which part of the value chain they can apply their cost-innovation advantages, or how to distribute these advantages over various activities, without jeopardising the value of a product or service.

Intangible assets, such as brand names and technology, are important factors when engaging in overseas activities. As latecomers, Chinese companies have not yet had the opportunity to build up these assets and are disadvantaged. High technology, variety or specialty products at a low price may not be convincing enough to break into markets where end customers display a high degree of brand loyalty (Williamson et al., 2010).

Conclusion

Over the last 30 years, the Chinese economy has experienced immense growth. China has become an economic and political force to be reckoned with and is bound to increase its influence even further. The startling domestic economic growth is promising, but China will face multiple challenges to sustain a certain growth while stabilising its institutions, averting possible social unrest, rebalancing its regional socio-economic disparities, diversifying its economic structure and addressing environmental and other civil society issues in the process. It is a gargantuan task to complete, but the Chinese people, corporations and government seem ready to push the country into a new stage of domestic consolidation and broader economic development.

References

-MOFCOM (2010). 2009 Statistical Bulletin of China’s Outward Foreign Direct Investment. Beijing: MOFCOM

-Rosen, D.H., Hanemann, T. (2009)., China’s Changing Outbound Foreign Direct Investment Profile: Drivers and Policy Implications. Washington D.C.: Peterson Institute for International Economics.

-UNCTAD. (2011). UNCTAD Statistics. Retrieved May 14, 2011, from http://www.unctad.org/Templates/Page.asp?intItemID=1584&lang=1

-Williamson, P.J., & Zeng, M. (2010). Chinese Multinationals Emerging Through New Global Gateways. Cambridge: University Press

Share on Facebook

Share on Facebook Share on Twitter

Share on Twitter Share on LinkedIn

Share on LinkedIn