Globalising China-Part 1: The Domestic Market of the People's Republic of China

In 1978 under the leadership of Deng Xiaoping (邓小平), China decided to gradually open up its economy to achieve more economic development. Three and a half decades later, China has become an economic force to be reckoned with, surpassing Japan as the second largest economy in the world in 2010. China’s economic success is no longer purely based on low- cost manufacturing, inward foreign direct investment and export. It has evolved into a diversified economy with a seemingly inexhaustible pool of low-skilled labour and highly- educated talent, a large number of up-and-coming enterprises with a competitive spirit and refreshing business ideas.

ASSISTED BY MORE LIBERAL economic policies, Chinese business is going global. Since China joined the WTO in 2001, Chinese Outward Foreign Direct Investment (OFDI) has surged, the number of Chinese greenfield investments has grown tremendously and Chinese companies

are increasingly acquiring targets in foreign markets. The staggering economic growth of China has garnered a lot of attention and, in many cases, the rise of China is perceived by governments and companies alike as a threat to national security, domestic economies and the overall business climate. How are Chinese firms, once domestic, now making the leap to becoming global entities?

China’s Economy

As the world is entering a new phase of globalisation, the economic centre of gravity is shifting rapidly from the Western world to emerging Asia. China’s enormous economic development plays an integral part in the economic surge of Asia. Since the financial crisis and economic recession in late 2008, the shift from West to East is even more tangible. Whereas Western economies have suffered and are still suffering from the crisis, Asian economies have shown more resilience in battling the demons of the global downturn. Building upon their experiences from the Asian financial crisis of 1997, Asian governments, especially China’s, have accumulated financial reserves and rolled out stimulus packages to secure domestic economic stability, improve infrastructure and continue policies to gain a global footprint.

Copyright: Xinhua

How are Chinese firms, once domestic, now making the leap to becoming global entities?

Since economic policies have gradually liberalised from 1978 onward, the Chinese economy has up until now recorded an average annual growth rate of about 10%. The rapid economic development and growth rates are mainly attributable to development in the eastern provinces and south-eastern coastal regions, the economic heartland of China,leaving peripheral regions such as the West and the North of China seemingly underdeveloped. To prevent the economy from overheating as well as to prevent excessive pollution and regionally uneven development, the Chinese government has created the all-encompassing 12th Five-Year Plan (“十二五”规划 Shíèrwǔ Guīhuà) 2011-2015.

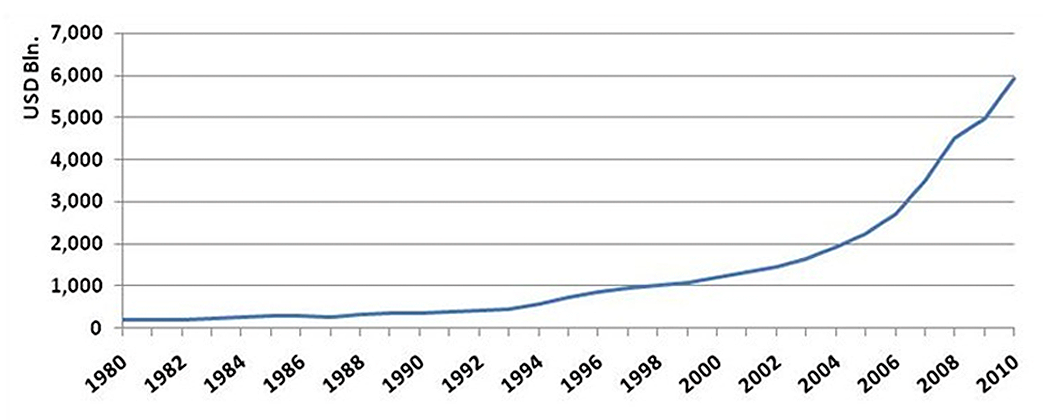

The size of an economy is measured by its nominal Gross Domestic Product (GDP). China’s nominal GDP has been growing strongly over the years (see Fig. 1) from 0.26 trillion USD in 1991 to 1.65 trillion USD by 2004. At a GDP growth rate of more than 13% on an annual base (with a slight dip during 2008 and 2009 to below 10%), Chinese nominal GDP has more than tripled in the six years since 2004. At the end of 2010, China’s nominal GDP was valued at 5.87 trillion USD, surpassing Japan’s 5.47 trillion USD, becoming the second largest economy in the world behind the United States (IMF, 2011). According to projections by Morgan Stanley Bank, China’s nominal GDP may triple over the next ten years, making it the largest economy in the world by 2020.

Fig. 1

Analysing the Purchasing Parity Power (PPP) per capita, on the other hand, reveals that China ranks only 85th in the world, with 6,828 USD (€4,945) on an annual base, according to statistics from the World Bank. China’s per capita income adjusted for PPP is only 15% of that of the United States (World Bank, 2011). These numbers illustrate that, although China has emerged as the second largest economy in the world by nominal GDP, it clearly remains a nation in development.

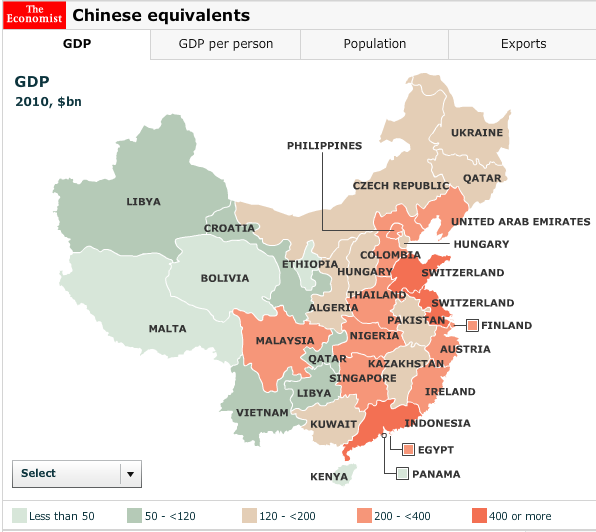

Major inequalities exist between the provinces in China, especially when perceived from the perspective of GDP per capita by administrative entity. Setting the province’s GDP per capita against comparable countries’ GDP per capita underscores the extensive nationwide differences (see Fig. 2). Whereas coastal provinces in the east and southeast have PPP levels similar to those of transition economies, such as Slovakia and Hungary or resource-rich states such as Saudi Arabia, South Africa and Kazakhstan, provinces in China’s interior have PPP levels similar to those of the least-developed nations.

Fig. 2

Is China’s Economy overheating?

The blistering pace at which the Chinese economy is growing has had positive side effects on development. At the same time, however, there is the anxiety that the ill-balanced economic growth may cause overheating. During the first quarter of 2011, the Chinese economy grew at a rate of 9.7% on the previous year, outpacing many forecasts. Despite the global economic crisis, which slowed down Chinese exports in 2009, the economy still recorded large growth numbers due to stimulated domestic consumption. This resulted in an upward pressure on Chinese price levels. The main threat for China is inflation. Since October 2009, the Consumer Price Index (CPI) has been rising. Food prices surged 11% in the first quarter of 2011 and housing property prices have also risen.

Recently, 24 commerce associations across the country made a joint statement to support the government’s effort to defeat inflation. The former Chinese Premier Wen Jiabao (温家宝) called on local government officials to help stabilise consumer product and housing prices. The rise in wages can compensate for inflation but only for a small proportion. A combination of rising inflation, concerns about social instability and labour shortages in key industrial areas have sparked a series of minimum wage increases across China in 2010 and in the first quarter of 2011. Money supply rose by 16.6% in the first quarter of 2011 due to foreign capital inflow and growing foreign exchange reserves. To control the money supply, the People’s Bank of China (中国人民银行 Zhōngguó Rénmín Yínháng) raised its reserve requirement ratio (RRR) for the fourth time this year, bringing the ratio to a record high of 20.5 percent. This is the tenth increase since the beginning of 2010.

Raising the RRR has slowed down bank lending, but the People’s Bank of China may now need to tighten regulations even further to control the money supply (Business Insider, 2011). The Chinese government acknowledges the threat of unsustainably high growth rates and inflation but it is confident that it can avert potential hazard through controlling measures. The question is how long the Chinese government can tame the dragon with artificial measures before a breath of fire will bury the economic landscape in ashes. The support for a stronger currency is growing wider. A stronger Chinese yuan could encourage growth in domestic consumption at the expense of investment and exports thus creating a more balanced economy (ANZ, 2011).

End of part 1

References

-ANZ (2011). Australia and New Zealand Banking Group. Trading with China: the Rise of Offshore Renminbi Business. Melbourne: ANZ

-Holmes, F. (2011). Will China’s Economy Overheat? Business Insider April 19th 2011

-IMF (2011). World Economic Outlook April 2011. Washington D.C.: IMF

-Segers, R.T., & Stam, T. (2013). Asia: Reshaping the Global Economic Landscape. Aix-la-Chapelle: Shaker

-The Economist. (2011).Comparing Chinese Provinces with Countries. Retrieved September 16, 2013, from http://www.economist.com/content/chinese_equivalents World Bank. (2011).

-World Bank Data Catalog. Retrieved May 6, 2011, from http://data.worldbank. org/

Share on Facebook

Share on Facebook Share on Twitter

Share on Twitter Share on LinkedIn

Share on LinkedIn